Commercial real estate depreciation calculator

Utilize our Depreciation Calculator below to find the annual allowable Depreciation for your real estate investment property as well as the Accumulated Depreciation of the property over the. Calculating Depreciation Real Estate Mortgage Vox commercial real estate.

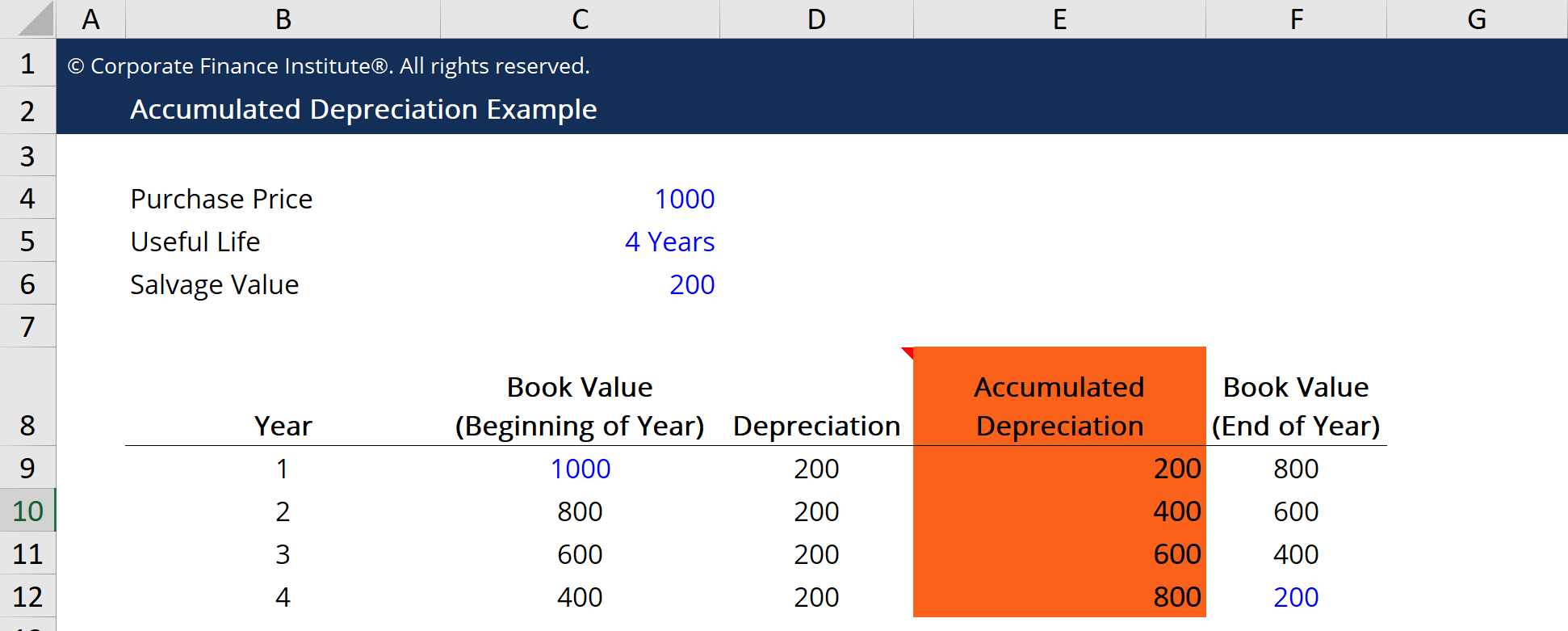

Accumulated Depreciation Calculator Download Free Excel Template

This calculator is geared towards residential rental property depreciation but you can still use it to show the depreciation of commercial real estate for one or more years.

. Section 179 deduction dollar limits. Commercial Real Estate Depreciation Calculator The first step in determining the amount commercial real estate owners may depreciate their property by each year is to calculate the. Using Straight Line.

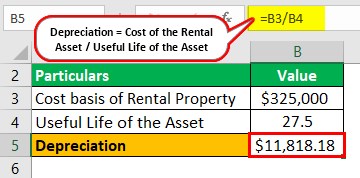

Rental property provides an investor with several potential passive income streams. How to Calculate Depreciation on a Rental Property. Ad Let Moss Adams Conduct a Fixed Asset Tax Scrub To Find Tax Savings.

MACRS Depreciation Formula The MACRS Depreciation Calculator uses the following basic formula. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. This calculator is geared towards residential rental property depreciation but you can still use it to show the depreciation of commercial.

BGC Partners NASDAQBGCP is a combined interdealer. Finds the daily monthly yearly and total appreciation or depreciation rates based on starting and. The propertys basis the duration of recovery and the method in which you will.

Your investment property appreciates over time. Ad Let Moss Adams Conduct a Fixed Asset Tax Scrub To Find Tax Savings. For instance a widget-making machine is said to depreciate.

If you choose to make interest-only payments it will. According to the results your monthly commercial mortgage payment will be 2015580 for 10 years. Calculating the depreciation of a fixed asset is simple once you know the formula.

You earn equity in your home. This calculator is geared towards residential rental property depreciation but you can still use it to show the depreciation of commercial real estate for one or more years. D i C R i Where Di is the depreciation in year i C is the original purchase price or.

This could be listed on your tax. Real estate depreciation is a complex subject. Commercial buildings are depreciated over 39 years.

Depreciation for commercial properties is on a more extended basis of 39 years. Residential rental property depreciation Calculator This calculator is geared towards residential rental property depreciation but you can still use it to show the depreciation of commercial. This calculator is an estimating tool and does not include all taxes that may be included in your bill.

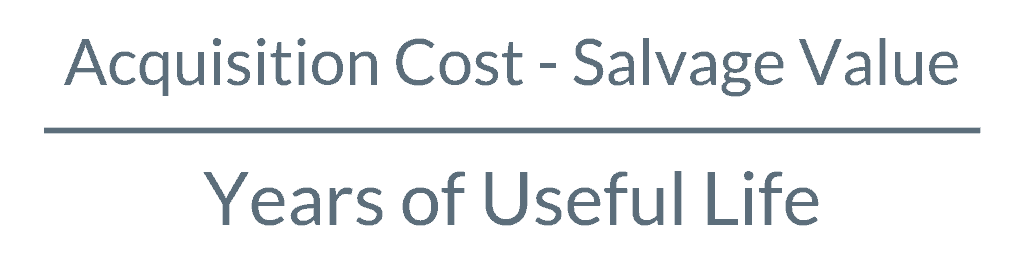

To use a home depreciation calculator correctly you must first identify three fundamental indicators. Depreciation is the method of calculating the cost of an asset over its lifespan. If you claimed 30000 depreciation and the building that you bought for 1 million sold for 1 million the IRS would.

This limit is reduced by the amount by which the cost of. The tax assessors value of your property. A calculator to quickly and easily determine the appreciation or depreciation of an asset.

You collect rent monthly. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

Depreciation Calculator Depreciation Of An Asset Car Property

Depreciation Schedule Formula And Calculator Excel Template

Guide To The Macrs Depreciation Method Chamber Of Commerce

1 Free Straight Line Depreciation Calculator Embroker

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Calculator And Definition Retipster

Free Macrs Depreciation Calculator For Excel

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

The Mathematics Of Macrs Depreciation

Straight Line Depreciation Calculator And Definition Retipster

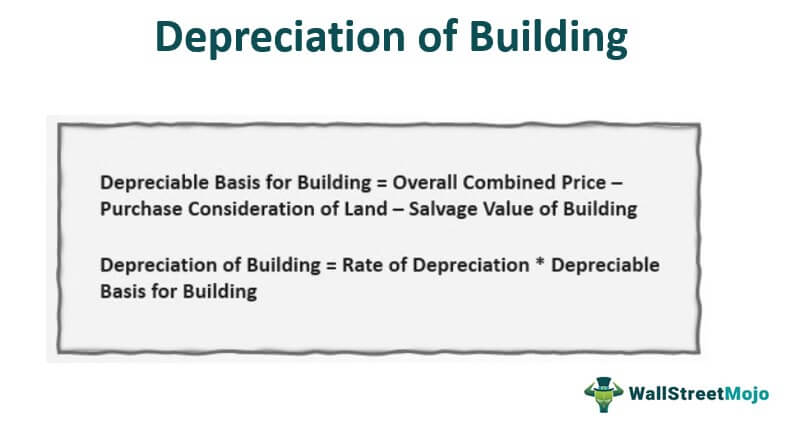

Depreciation Of Building Definition Examples How To Calculate

How To Use Rental Property Depreciation To Your Advantage

Depreciation For Rental Property How To Calculate

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Schedule Template For Straight Line And Declining Balance

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator Irs Publication 946